GameStop share price hits a new record high after Elon Musk tweets about it

The GameStop story continues to be a wild ride—the chairman of Virgin Galactic is also now a shareholder.

This article was updated on January 26, as Gamestop's share price continued to climb to record heights, driven in part by a tweet from Elon Musk. Click here to get caught up.

It's been a long time since GameStop had any real relevance for PC gamers. I used to love popping in and rifling through the bargain bins in search of sub-$10 boxes, but the rise of Steam put an end to that pastime ages ago. It was a slower spiral down for consoles, but the company has struggled for years to shore up its declining business. That's been reflected in its stock price, which has slowly settled from more than $60 in 2008 to well under $10 since mid-2019.

A very strange thing happened last week, however. GameStop's price very suddenly skyrocketed to nearly $120 per share. That's odd enough in itself for a company that once seemed destined to suffer a Blockbuster-style fate, but what makes it even weirder is the central role that Reddit played in the whole thing.

The wheels actually started turning on all this last year. As reported by Wired, GameStop's dire straits led some investors to "short" the stock. In a short, investors win if the price of a stock decreases. It works like this: The investor borrows a bunch of shares of a company and then sells them. At that point, they have a bunch of cash and no shares, but the shares weren't actually theirs, and they eventually they have to return them. When that time comes, they have to buy back the number of shares they borrowed, hopefully at a lower price than they sold them for so that they earn money on the difference. The risk, of course, is that the price unexpectedly goes up instead of down, in which case the short-sellers lose money because they have to pay more to buy back the shares than they sold them for.

That's what happened here. GameStop's share price began to show signs of life last summer when Chewy co-founder Ryan Cohen bought a hefty stake in the company and began advocating for major changes. It got a further lift in October 2020, when GameStop announced a major, multi-year partnership with Microsoft to incorporate its technology into its back-end and front-facing retail operations, and to serve as a distribution center for the Xbox All Access program.

"GameStop's extensive store base, focus on digital transformation in an omni-channel environment and expert gamer associates remain an important part of our gaming ecosystem, and we’re pleased to elevate our partnership," Xbox head Phil Spencer said at the time.

The company's 2020 holiday sales results were also positive: Total sales were down 3.1 percent, but comparable store sales were up 4.8 percent, while "e-commerce" rose by 309 percent. The news was good enough to lift GameStop's price even higher. Then, on January 19, as shares reached the $40 mark, short-seller Citron Research posted this warning:

The biggest gaming news, reviews and hardware deals

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Tomorrow am at 11:30 EST Citron will livestream the 5 reasons GameStop $GME buyers at these levels are the suckers at this poker game. Stock back to $20 fast. We understand short interest better than you and will explain. Thank you to viewers for pos feedback on last live tweetJanuary 19, 2021

That may have been a strategic mistake, because shortly afterwards, Reddit got involved.

"The WallStreetBets subreddit (largely daytraders) decided to mess with them and make some quick money," industry analyst and consultant Michael Futter told me. He also clarified that the subreddit's actions had nothing to do with propping up an ailing company out of some bizarre sense of nostalgia, or with videogames in general. "They aren't interested in GameStop as a company. It could quite literally have been ANY company."

GameStop's price went up so rapidly, Futter said, because a relatively large number of people, including conventional investors wanting to get in on a hot stock and short-sellers needing to cover loans being called in, were suddenly trying to buy a limited number of shares in the company. The increased visibility brought about by "the Reddit effect" drove trade volumes even higher.

"Reddit definitely helped push it higher," Futter said. "Think of it like amplifying any other kind of trolling. They are creating signal above the noise. The Reddit stuff is material, because it led to Gamestop being the most traded stock on the market on Friday. Without r/WallStreetBets, that doesn't happen."

Sure. Why not. pic.twitter.com/FXlrFsxbnpJanuary 25, 2021

The WallStreetBets subreddit is not a conventional source of investment advice. It is, in fact, pure Reddit, filled with insults, slurs, and threads like "Took my dad's life savings and Yolo'd into BB [Blackberry], told him it's either retirement on a yacht or foodstamps for him." In fact, while making money is obviously a bonus, a significant number of redditors involved seem chiefly committed to causing headaches for "serious" investors. Citron's Andrew Left posted a video on YouTube in which he implied that some members of the subreddit were having pizzas delivered to his house and signing him up for Tinder, and "doing all those cute things trying to hack my Twitter account."

Too many people hacking Citron twitter, will record and post later today. $GME going to $20 buy at your own riskJanuary 21, 2021

"That's why we're so good. Hedge funds compete against hedge funds," one redditor said. "This means they have no idea how to counter the [WallStreetBets] plan because it is based on positive sentiment, 🚀 emojis, and buying the one stock they were sure nobody wanted anymore. But, here we are."

After peaking at $144 earlier today, GameStop's share price has been bouncing between $65-80, a big drop but still way above where it was trading two weeks ago. I have no idea where it will go from here, but even if it ends up at just half of where it currently is, that still puts the price well ahead of where it was when this ride began—and leaves short-sellers in a tough spot.

It's interesting to note that all of this was simply the machinations of the market, and that GameStop itself has essentially been an observer throughout. I've emailed the company for comment, and will update if I receive a reply.

Day two: Gamestop continues to climb

The Gamestop ride continued today as the company's share prices rose to a new high of $148. But that wasn't the end of it: The price shot past $230 in after-hours trading, a surge attributed largely to Elon Musk, who shared his particular brand of market insight on Twitter, along with a link to the WallStreetBets subreddit:

Gamestonk!! https://t.co/RZtkDzAewJJanuary 26, 2021

Musk isn't the only high-profile figure with deep pockets to hop aboard the Gamestop train. Chamath Palihapitiya, the chairman of Virgin Galactic and founder of the venture capital firm Social Capital, is also now a GME shareholder.

Lots of $GME talk soooooo....We bought Feb $115 calls on $GME this morning. Let’s gooooooo!!!!!!!! https://t.co/XhOKL1fgKN pic.twitter.com/rbcB3Igl15January 26, 2021

Some rich people are clearly having fun with the chaos, but others are likely sweating bullets: According to Business Insider, short seller losses on Gamestop in 2021—which is still less than a month old—have now hit $5 billion. The Wall Street Journal reported yesterday that Melvin Capital Management required a $2.75 billion investment to stabilize the company after it took massive losses on short stocks including Gamestop.

A highly-upvoted message on the WallStreetBets subreddit emphasized the more personal nature of the Gamestop run among retail investors, and not-too-subtly suggested that, unless someone figures out a way to make all of this illegal (which is not at all out of the question), it will happen again.

"Remember that scene from the Sopranos, where Tony's wife calls to buy 5000 shares of Webonics, after she was manipulated emotionally to so? Institutions and hedge funds want us to be stuck in that world," redditor benaffleks wrote. "They're scared of the future. They're scared because, so much information is available for free now. THere's no more fees for trading. We have large communities that discuss stocks and trading openly. We can think and make decisions for ourselves, which scares the FUCK out of old school institutions and hedge funds."

While Gamestop appears to be the priority right now, the subreddit has also reportedly turned its attention to AMC, Bed Bath and Beyond, and Blackberry.

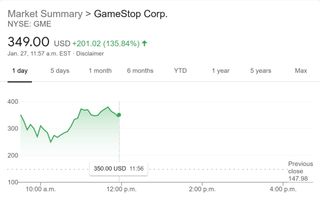

Update: On January 27, the morning after Musk's tweet, Gamestop opened at an astonishing $350 per share. It tailed off quickly, sinking to around $250, but then climbed back to the $350 mark, where, as of 12 pm, it's holding steady. We'll keep watching to see where it goes from here.

Andy has been gaming on PCs from the very beginning, starting as a youngster with text adventures and primitive action games on a cassette-based TRS80. From there he graduated to the glory days of Sierra Online adventures and Microprose sims, ran a local BBS, learned how to build PCs, and developed a longstanding love of RPGs, immersive sims, and shooters. He began writing videogame news in 2007 for The Escapist and somehow managed to avoid getting fired until 2014, when he joined the storied ranks of PC Gamer. He covers all aspects of the industry, from new game announcements and patch notes to legal disputes, Twitch beefs, esports, and Henry Cavill. Lots of Henry Cavill.

Most Popular