Esports market predicted to grow to $463 million in 2016

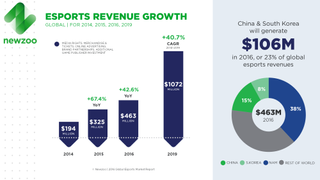

ESPN recently became the ESPN of esports, and if you're not sure what prompted that move, a report on the predicted growth of the global esports market in 2016 put together by research firm Newzoo may offer a hint. The report says the esports market value is expected to grow by 43 percent this year, from $325 million last year to $463 million in 2016, and to break $1 billion by 2019.

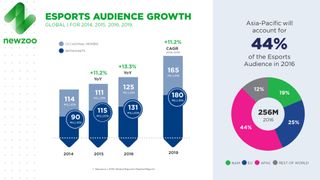

North America will remain the top revenue-generating market for esports in 2016, with an anticipated $175 million rung up through “merchandise, event tickets, sponsorships, online advertising and media rights.” In terms of actual audience share, however, Asia leads the way, accounting for 44 percent of global esports enthusiasts, with growth driven “by an explosive uptake in Southeast Asia.” The total audience is expected to grow to 131 million “esports enthusiasts” worldwide, plus another 125 million “occasional viewers” who tune in to catch the big events.

“2016 will be pivotal for esports. The initial buzz will settle down and the way forward on several key factors, such as regulations, content rights and involvement of traditional media, will become more clear,” Newzoo CEO Peter Warman said in a statement. Expressing a note of caution, he added “The collapse of MLG was a reminder that this market still has a long road to maturity and we need to be realistic about the opportunities it provides.”

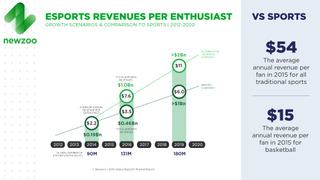

The predicted 43 percent growth of the esports market in 2016 is actually slower than that of 2015, during which the market value increased by more than 67 percent. The average annual revenue per esports enthusiast is expected to increase from $2.83 in 2015 to $3.53, a nice jump but still significantly less than per-enthusiast revenues generated by traditional sports: Basketball, for instance, generates $15 per fan per year. However, the esports audience is “a very valuable demographic, skewing towards consumers with a full-time job and relatively high income,” which it's not shy about blowing on digital media, hardware, and mobile content.

What it means, simply put, is that there's money in them jungles, and an increasing number of companies are going to be grabbing for it. The scene is currently dominated by Valve, Riot, and Blizzard, but Activision's recent acquisition of MLG is a clear indicator that it's serious about claiming a piece of the action, and ESPN's esports about-face was unexpected but, in hindsight, not all that terribly surprising. And more will follow.

“An increasing amount of traditional media companies have become aware of the value of the esports sphere and have launched their first esports initiatives. With these parties getting involved, there will be an increased focus on content and media rights,” Newzoo said. “All major publishers have increased their investment into the space, realizing that convergence of video, live events and the game itself are providing consumers the cross-screen entertainment they desire from their favorite franchises.”

The biggest gaming news, reviews and hardware deals

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Andy has been gaming on PCs from the very beginning, starting as a youngster with text adventures and primitive action games on a cassette-based TRS80. From there he graduated to the glory days of Sierra Online adventures and Microprose sims, ran a local BBS, learned how to build PCs, and developed a longstanding love of RPGs, immersive sims, and shooters. He began writing videogame news in 2007 for The Escapist and somehow managed to avoid getting fired until 2014, when he joined the storied ranks of PC Gamer. He covers all aspects of the industry, from new game announcements and patch notes to legal disputes, Twitch beefs, esports, and Henry Cavill. Lots of Henry Cavill.

Most Popular